The best career advice I ever received is that life is fundamentally better as an optimist. With the added wisdom that not only will people like you more, but you’ll be far more professionally successful. That advice was given to me during a particularly difficult month on the trading floor, when it felt as though every market call I made was hideously wrong, and my p&l was a particularly persistent and stubborn shade of red.

This advice feels all the more pertinent as the venture zeitgeist has morphed from a confluence of discussions around valuation compression in Q1, to a recognition that the coming recession will not be short and shallow. Indeed, with the ever-growing tide of evidence which shows how inflation has spiralled out of control, we’re now facing a recession more akin to those of the 1970s and 1980s. With that murky background it might seem challenging to find my source of optimism — but for those who are willing to bear with me, I am convinced there are several compelling reasons for optimism amongst LPs, investors, and most importantly founders.

First of all — the wrong comparisons are being drawn.

We’ve all seen the projections on what happens if funding sees a comparative drop to ’01: but this is not ’01. The most important distinction to be made is between the drivers of this economic contraction. The 2001 correction can be defined as extended valuations finally losing their lofty heights and returning to earth, alongside a fairly shallow recession. This was largely driven by private sector leverage (a characteristic of most post-1990 recessions). This is radically different from today’s central issue of inflation suppression.

Moreover, there is a substantial difference in the positioning of young and unprofitable companies (or YUCs as some analysts affectionately refer to them). Analysts at the Leuthold Group noted how the tech sector peaked at 34% of the market in 2000 yet contributed only 8% of nominal GDP. Whereas, in the current cycle, it peaked at 27% and contributed 18% to nominal GDP. I’m likely preaching to the choir here, but there is sufficient evidence to believe that tech is secular.

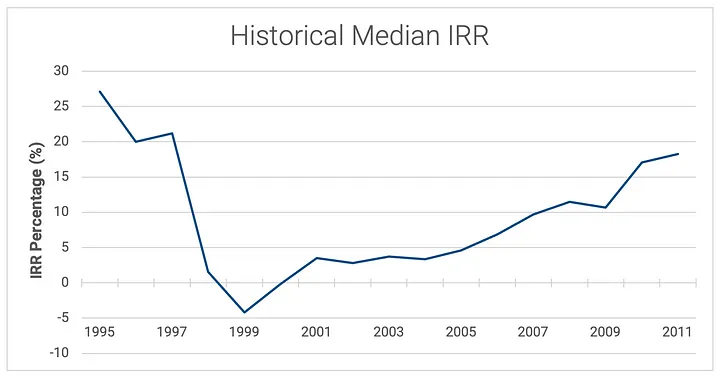

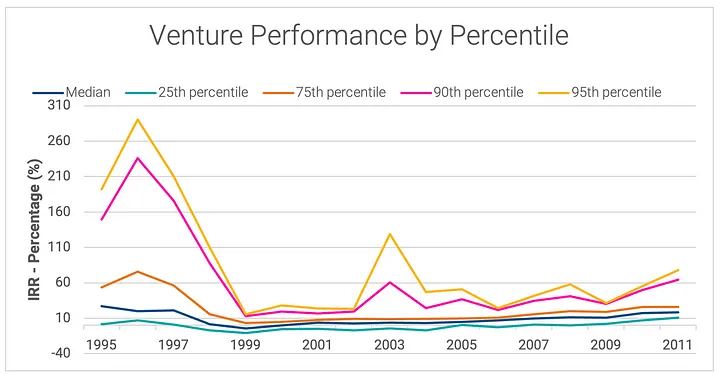

This also comes through in some of the analysis shared by Cambridge Associates, who note that revenue and revenue growth were largely absent from many companies funded in the 1999–2000 era. Which goes some way to explaining why the 1999 vintage still reports an overall negative IRR as shown below.

Finally, GP behaviour should also be theoretically different given the most discussed difference — which is of course the mountain of dry powder, with estimates of $539bn globally as of July.

Misguided comparisons aside, there is also an argument to be made that whatever the chaos caused by the end of the Gargantuan era, venture can be viewed as a safe haven asset class.

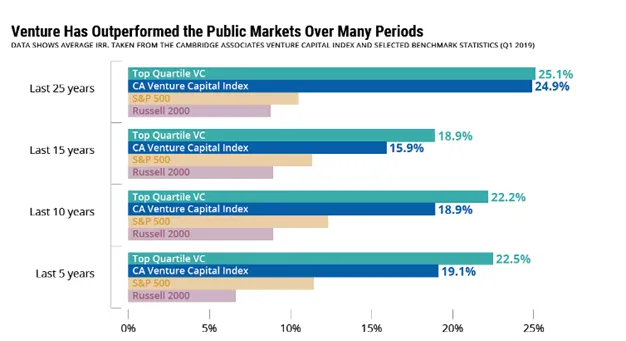

The traditional definition of safe haven is defined as ‘retaining or increasing value during times of economic uncertainty’. Which is true of VC given the data on the ability of top quartile funds to continually replicate success, driven by the underlying information asymmetry which exists in the industry. The common public markets refrain ‘that past performance is no indication of future performance’, is not a consideration for consistent LPs considering new allocations.

Moreover — top quartile VC returns strongly outperform other comparative asset classes.

Leaving my optimism aside, the current market environment does provide a silver lining for even the naysayers. A return to normalcy is far from a bad outcome. Fund sizes had been incredibly bloated in recent years, and capital was being called incredibly quickly. Warren Buffett put it vividly in his 2003 Chairman’s letter to shareholders: “Investment managers often profit far more from piling up assets than from handling those assets well. So when one tells you that increased funds won’t hurt his investment performance, step back: his nose is about to grow.”

Finally, it is worth remembering that venture is an asset class blessed with an abundance of time. Keynesian ‘animal spirits’ are defining qualities of venture. Or in other words, the human tendency to take risks even when more rational analysis would suggest a more cautious decision. Our bet as venture capitalists, is that those animal spirits will find a way to build the next cycle out of the ‘bust’. At OMERS Ventures we are well placed to be patient participants as this next cycle unfolds, as we aren’t bound by traditional fund structures.

I’ll pause my glass half full ode for a moment. I am in full acknowledgement that it might well get worse before it gets better. That is particularly the case for Europe. The latest CB insights data from Q2 shows that European funding has experienced the relatively smallest decline (~13%). In comparison, the US and Asia have each seen a -25% contraction QoQ. Moreover, I’m in no doubt that there is a high hurdle for investments completed at recent elevated valuations to return the scale of capital which investors are seeking. But despite this, there is every reason to believe that we can relearn to live with both inflation and volatility.

The challenges ahead are substantial, and I’m in no way trying to minimize the near term difficulties which many in tech and the wider economy are facing. Indeed, for those looking for advice on how to navigate with empathy, my wonderful colleague Jennifer Janson has recently written on this topic. However, as put so aptly by Katherine Boyle, “technology is the font of this reversal [of pessimism]”. As someone relatively new to the industry, I have no qualms that this is the landscape I find myself in as I set about building with the OV team.