For many months now there has been heightened debate about the value of forcing a return to the office. The stance of tech companies has varied widely — from Elon’s edict to Tesla employees to ‘return to the office for 40 hours per week or leave the company’ to Shopify’s shift to ‘digital by default’ strategy, suggesting ‘office centricity is over’. The decisions being made around whether to force employees to return to a physical workspace were already challenging enough, but on top of a financial shock, and a drive by many VC-backed businesses to reduce costs and extend their cash runway, suddenly the cost of office space is taking on a whole new light.

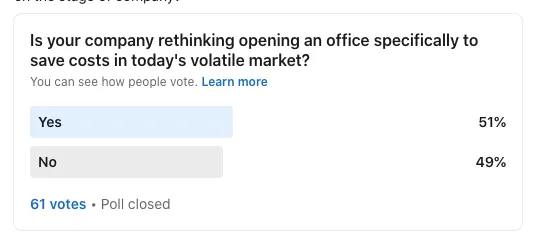

Based on my many conversations with founders and management teams both within our portfolio and beyond, runway is a hot topic. I am getting the distinct feeling that many early stage companies are deciding to not open an office in order to save costs. To see if this is true, I polled my network and the results were pretty split:

Making the decision to open an office based on costs is risky and short-sighted on behalf of management. The decision between opening an office vs staying remote should be a strategic one, based on the culture you want to set for your company and setting norms around team interaction. Though our poll suggests that for more than half the people who responded, cutting costs is a driving factor in the decision.

I think this is a dangerous path to go down and suggest three key things to consider when contemplating whether or not your business needs an office:

(1) Is the office a discretionary cost?

During COVID, companies made it work without an office and survived, were productive, made revenue, shipped product, and hired people. We all proved the office is discretionary. Or did we? Is it as easy as just simply cutting out our office space, in the same way we might stop free lunches? I’d argue it needs more thought than that. With office space being one of the biggest expenses on your P&L, there is more to the decision than the bottom line. Moving remote is not “free”. It must be weighed against those critical collaborative offsites for a dispersed team, regular travel and remote office setups.

According to Landed co-founder, Alex Lofton, “Offices and their role in your culture and ability to produce what you set out to produce in the world are a tool. A tool is discretionary if it isn’t a part of the formula you have for success. If it is part of your formula, then it is as essential as laptops or a software subscription.” Landed has opted for a balance of in-office and work-from-home to achieve its goals.

Matt Giffune at Occupier also shared his views: “While we are largely a remote company, we do have office hubs in Boston, New York, and Austin, and we encourage, but do not demand, that folks in those cities come into the office when they want. If companies are too focused on the cost burden of an employee with respect to office space, they will lose sight of what really matters, which is keeping employees engaged in their personal and professional development.”

(2) Unproven models mean more risk

From an investor perspective, I can point to many successful companies that have taken an office first model. In the Bay Area, big tech companies like Facebook and Apple have taken this to an extreme where they have built campuses.

On the remote front, it is more challenging. Fewer playbooks exist. That isn’t a bad thing, and I expect to see many emerge in the next decade, but right now, proven successful models are limited.

When I am looking at investing in a business, I acknowledge a bias toward teams that work together in real life. It doesn’t preclude investments in remote teams, but it does mean from a diligence perspective that there are additional steps to take to critically assess whether the business has really thought through the implications of growth and scale in a remote environment. And it is harder for me to have conviction around that simply because the model is still so new.

(3) Stage of company

From my discussions, early stage companies are leaning more to in-person work to maximize collaboration, build a strong company culture, and feed off of each other’s energy. From what I am hearing it also makes it easier to iterate quickly and brainstorm.

This resonates with Christine Wendell, Co-Founder and CEO at Pronto Housing, an affordable housing compliance and leasing software company, who has raised $4.5M from venture investors to date: “ being in the office has been critical to accelerate the growth of our product, and foster solutions to address our customers’ needs. We’ve found that, at our stage, in person conversations are much more productive to brainstorm about a new product feature, catch up about a customer implementation, or discuss anything that benefits from creativity and collaboration.”

Meirav Oren is the CEO and Founder of Versatile, a construction productivity solution, which has raised over $100M from venture investors to date. Her view on the office as a growth stage company is that cutting costs should not be the main reason to let go of the office.

“Close interaction is critical for R&D and innovation, but also for a sense of belonging, for much better communication, and less management time spent setting expectations and tracking results.

That said, talent is everywhere. By building a remote or semi-remote environment, you can get the best people, wherever they may be (just make sure to bring them together regularly, which was not possible for over two years). We built our US operations based on talent and proximity to customers, not offices. I would do it again, especially with the ability to bring people together regularly.

In my view, the decision to have an office or not, should be based on the strategy and culture, never on cost.”

The story continues to unfold

It’s no secret that I love numbers and data. I am looking forward to data that shows whether being together in real life for any regular period of time is an indicator of success for early stage businesses. With widespread concerns about COVID seemingly abating, and far fewer (if any) restrictions in place, the real test starts now. Will the best cohort of companies started in 2022 be in real life or remote first? Will it matter?

In a time when cash is extra important and companies are cutting burn, the office now looks like a discretionary spend. But think hard before cutting your office costs altogether, simply as a cost saving exercise. You may lose more than just the entry on your P&L.