The VC world is often criticized for being shrouded in secrecy. Well, consider this our attempt to reveal the magic that happens in the black box…or part of it anyway.

The way we at OMERS Ventures tackle markets is to go deep on a couple verticals at a time. We’ve previously done this with healthtech, proptech and insurtech and it has led to great investments. We think it’s important to know as much about a market and how it’s evolving as we can, as it shortcuts conversations to the stuff that really matters. We can dive straight into a debate about why our thesis on a space might be wrong, or how a founder plans to overcome obstacles and challenges we already know exist.

As part of the team focused on vertical SaaS investments, we intend to take a similar approach. But taking this targeted approach requires prioritization. Not all verticals are created equal; some will be more fruitful than others. And spending too much time going down rabbit hole after rabbit hole can be a death trap. So as we continue to expand our interest in ‘niche’ markets we set out to do a top-down, data-driven analysis of all possible verticals in a standardized, systematic way.

To do that, we needed two key things:

1. A mutually exclusive, collectively exhaustive (MECE) framework for categorizing businesses into discrete verticals.

2. A comprehensive, macro-level dataset that mapped to the MECE framework

Luckily, we didn’t have to reinvent the wheel here.

We used the North American Industry Classification System (NAICS) as our organizing standard. NAICS is a coding standard used to classify business activities. It’s the universal coding schema used by federal statistical agencies in Canada, the US, and Mexico to collect, analyze, and publish data related to the business economy.

The US agencies (e.g., Bureau Labor Statistics, Census Bureau, etc.), in particular, do an incredible job making this data publicly available, accessible, and easy to interpret.

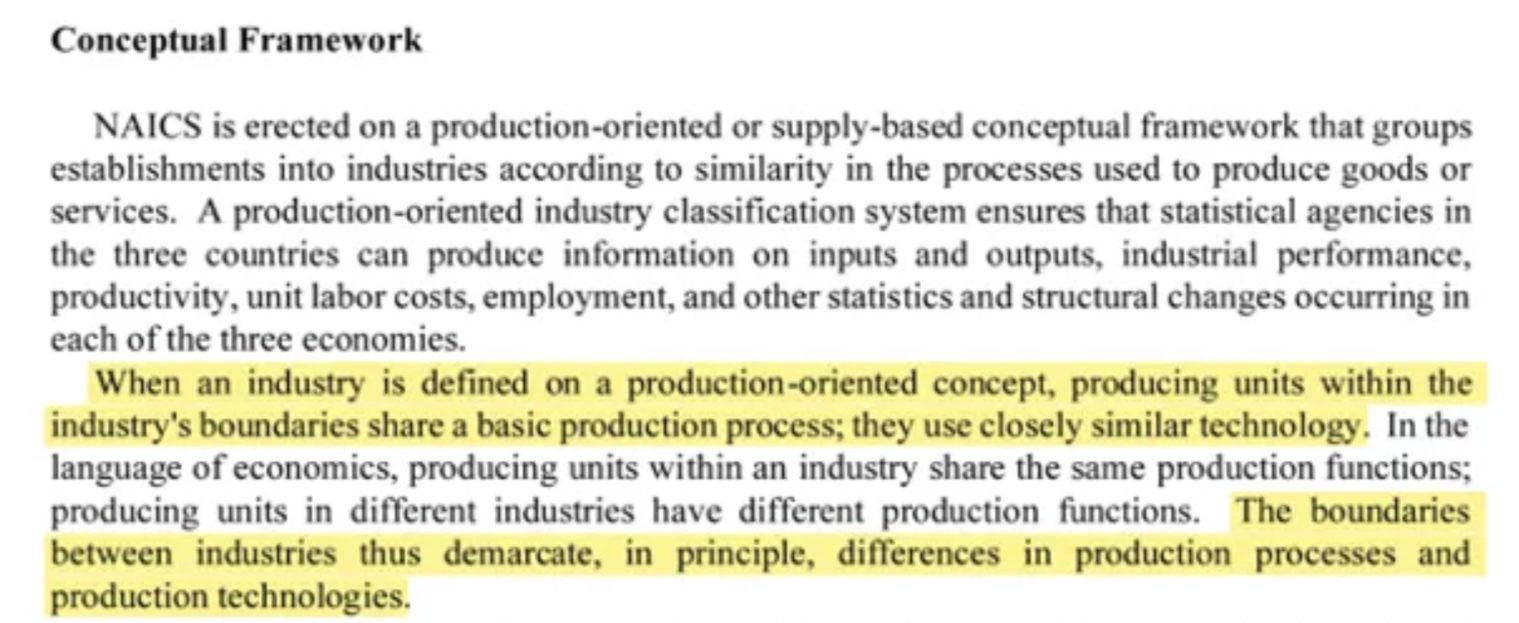

The NAICS’ conceptual framework also ties directly to technology, meaning it’s a reasonable way for us, as vertical SaaS investors, to demarcate verticals.

Source: 2022 NAICS Manual

In the US, NAICS codes map to the following structure of sectors, subsectors, industry groups, and industries:

Source: 2022 NAICS Manual

Now, which level (sector, subsector, industry group, or industry) should be considered “verticals” is up for debate. We did our analysis at every level and ultimately decided the industry group level provided the right balance of breadth and specificity without introducing too much noise.

So the next step was determining which characteristics would be the most important to evaluate. These parameters needed to correlate with the likelihood for vertical SaaS success and had to be easily investigated using US Census data.

Parameter #1: fragmentation

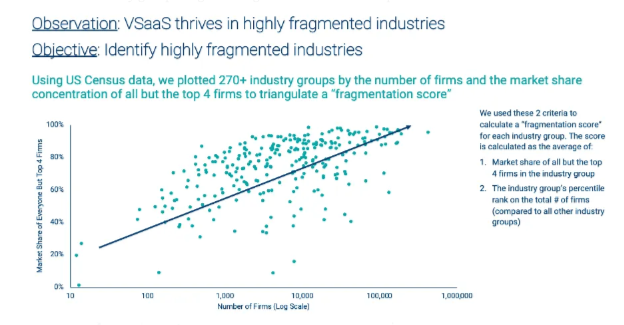

Looking back at historical vertical SaaS winners, it’s clear that vertical SaaS tends to thrive in highly fragmented industries. So we set out to analyze the degree of fragmentation for each of the 270+ NAICS industry groups we had data on.

Importantly, fragmentation isn’t just determined by the sheer number of businesses. It’s also a product of market share concentration. We used both of these to derive a fragmentation score for each industry group.

Parameter #2: efficiency

Historically, vertical SaaS has often served as the catalyst for digital transformation of legacy “pen and paper” industries. But quantifying an industry group’s degree of digitalization isn’t so simple. We settled on a proxy: efficiency.

Our thought process was as follows: digitalization tends to improve industry efficiency. Therefore, we can use efficiency as a quantifiable proxy for digital sophistication. There are a lot of ways to potentially measure efficiency. Based on the data available, the best proxy in our view was revenue per employee.

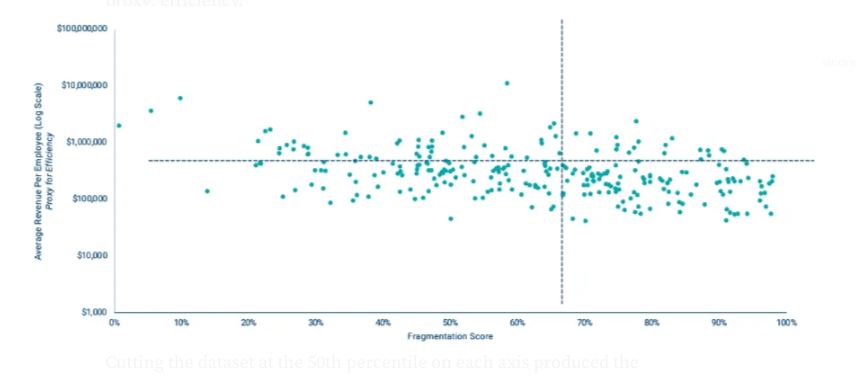

So, we calculated revenue per employee for the same 270+ industry groups we derived fragmentation scores for, and plotted them on an efficiency (y-axis) vs. fragmentation (x-axis) matrix, shown below.

Cutting the dataset at the 50th percentile on each axis produced the following 4 quadrants:

Top left quadrant: low fragmentation, high efficiency. In our view, these verticals possess fewer potential buyers with less urgency/incentive to buy vertical SaaS.

Top right quadrant: high fragmentation, high efficiency. In our view, these verticals possess more potential buyers with less urgency/incentive to buy vertical SaaS.

Bottom left quadrant: low fragmentation, low efficiency. In our view, these verticals possess fewer potential buyers with greater urgency/incentive to buy SaaS.

Bottom right quadrant: high fragmentation, low efficiency. In our view, these verticals possess more potential buyers with greater urgency/incentive to buy SaaS.

As a gut check, we mapped a sampling of vertical SaaS winners and emerging startups we’ve come across back to the industry groups they serve. A couple outliers like Veeva and Procore plotted in other quadrants (top left and top right, respectively), but the overwhelming majority — including Mindbody, Toast, TouchBistro, Jobber, and ServiceTitan— plotted in the bottom right quadrant.

Parameter #3: IT spend

What would a successful outcome be in vertical SaaS? The general heuristic VCs follow is to look for a path to $100M+ in annual revenue within a 6–10 year period, which on a 10x revenue multiple, points to $1B+ in exit potential.

The ability to reach $100M+ in revenue depends on how much money, in aggregate, the businesses in that vertical have to spend on the SaaS (TAM) and the vertical SaaS company’s ability to efficiently penetrate that market (market share).

A “successful” vertical SaaS startup could therefore come about in a variety of ways: by getting nominal market share in very large TAMs or by getting market-leading share in smaller TAMs. The smaller TAM targeted, the more market share that needs to be captured.

While historical vertical SaaS winners were able to achieve market-leading share, we think this will become more challenging for new entrants going forward. So in our prioritization framework, we’ve chosen to look first at highly fragmented, less efficient verticals (in the bottom right quadrant) with the largest TAMs, where only 1–2% market share is needed to achieve venture-scale outcomes.

As an aside, two of the first verticals we chose to pursue were legal services and automotive. We’ll be publishing our thoughts on each of those in subsequent posts, so keep an eye out!

A methodology in motion

Obviously this prioritization exercise is just one piece of the puzzle. There are many other factors at play, and we acknowledge there are multiple ways to win in vertical SaaS (i.e., winners aren’t constrained to just the most inefficient, highly fragmented industries with $5B+ in IT spend). So we always combine this top-down, data-driven analysis with bottom-up and more qualitative validation work before choosing verticals to pursue.

The next two verticals we’re actively digging into are dental and life sciences. If you’re a company builder, customer, investor, or general subject matter expert in either of these industries we want to hear from you! Drop me a line at mmoore@omersventures.com and let’s chat.

PS. All this data-driven work should not make you think that we don’t rely on many other factors when making investments…it is simply the first step in helping us prioritize the ponds we want to be fishing in.