Imagine sitting in front of your laptop staring at a bunch of line graphs and bar charts wondering what they mean. Or better yet, what to do next with the eventual insight. In many instances in my prior operating roles, this was me (don’t tell those past teams!). The exponential growth in tech stacks has led to an incredible amount of choice when it comes to what data to use and how.

To say that many businesses struggle with the ability to derive value from the avalanche of data they have access to is stating the obvious. Data capture is now readily available for almost every area of a business, but what’s missing is a through-line connecting multiple sources with broader insights. The increase in available data has come with a corresponding decrease in its value, as most stays fragmented and siloed, creating an underused archive of critical insights sitting dormant.

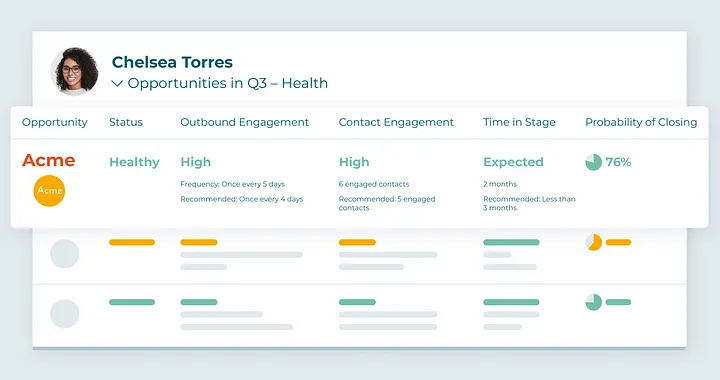

We know that go-to-market teams typically work in one or a few dedicated applications that provide singular insights, but don’t make the leap to recommended actions, or cross-reference with other data sources for deeper analysis.

Enter Falkon.

The company that we believe will win in the race to finally make data insight actionable for every business. And let me tell you why.

After countless conversations with go-to-market leaders, data strategy operators, investors, and our own past experiences, we’re excited by four key areas addressed by Falkon: the proactive data inclusivity, the speed to insight, the fact that it is function specific but operationally expansive, and the ability to offer data insights and a direct link to recommended action in existing workflows.

Core go-to-market data stacks are generally well-defined, and Falkon’s platform takes advantage of that and provides an easy method to stitch together fragmented data sources. It then applies tried and true best practices for go-to-market analysis and insights and translates them into a day-to-day workflow, using integrations and notifications. Immediately, go-to-market teams can get not only get critical yet basic reporting (that’s typically been hard to get) but also clear and direct insights that can impact your topline — like how to improve rep productivity or win rates.

Falkon is a modern ‘data stack in a box’ for go-to-market (GTM) teams. Even better, it provides a new layer of analysis and automated recommendations, leaving GTM teams smarter and more efficient than ever. It combines data from your CRM, your data warehouse, your product data, and other systems to build a powerful GTM-focused certified data pipeline. This allows businesses to create an expansive data model for each of their customers. It’s also a trending database — addressing the inability to track changes over time that has long been an issue in the GTM tools of today.

On top of that data platform, Falkon has a suite of apps that leverage the data to deliver insights within several GTM categories like marketing, sales, and product-led growth (PLG) use cases. Falkon connects all the above data and insights directly to wherever work is done, integrating with tools like Salesforce, Outreach, Salesloft, Slack, and more to deliver insights to GTM teams and prompt/suggest next steps.

Spotting a winning team

One of the qualities we think about when evaluating an investment opportunity is founder-market fit. Founder Mona Akmal has built a deep career in tech across companies like Microsoft, Code.org, and Zulily. With her experience at Amperity, a customer data platform, Mona is ideally positioned to build the tool she always wanted to have in the roles where she thrived.

I’ve written a lot about the importance of building a relationship with our founders. We’ve gotten to know Mona over the past year, as she navigated macro highs and lows. Through our many conversations, we’ve been able to develop a great partnership of healthy debates, disagreements, and, of course, laughs. We’ve learned lots about Mona from her journey to Seattle from Pakistan and her incredible product background. We admire her determination, her fire, and her grit. As part of our reference calls, we heard time and again that “Mona gets stuff done, she does not mess around.”

The venture business is all about making big bets. In this case, there’s no doubt the market is there, the real question is who the right team is to build the business that wins the category. We have no doubt that if anyone can do this, Mona can. So, we’ve put our money where our mouth is. We’ve led the company’s $16M financing round alongside Greylock Partners, Trilogy Financial, Flying Fish Partners, and Madera Partners.

As a former operator myself, this is a product I wish I’d had access to years ago. I’m proud to support a business I know will offer so much value to businesses of all types and sizes — I can’t wait to see where the company goes from here!