Continuing our series on Vertical Software (VSaaS), we’re spotlighting the latest sector we’ve been focused on: Autotech. We’ve highlighted before that we believe successful VSaaS companies emerge from fragmented markets with low efficiency so it should come as no surprise that the automotive sector scores highly here.

State of the Nation(s)

The automotive industry stands as a cornerstone of the US economy. Beyond employing millions, it anchors the nation’s manufacturing sector. Car ownership doesn’t just influence the US economy — it’s integral to the American lifestyle. Its critical role was evident when, uniquely, it was the sole non-financial sector to secure a bailout during the 2007–09 financial crisis.

Currently, the automotive sector contributes over $1 trillion to the U.S. economy annually, representing about 4.9% of GDP. Beyond just vehicle manufacturing, the industry sustains jobs through its broad supply chain and a comprehensive retail and maintenance infrastructure. In total, the auto industry supports approximately 9.6 million jobs across the US.

The sector has played an equally important role in the Canadian economy and has recently seen a revival through electrification. As one of the world’s top 12 light vehicle producers, Canada hosts five global OEMs that collectively assemble over 1.4 million vehicles a year. Canada has also recently been the spotlight of the Electric Vehicle (EV) industry with Stellantis and LG Energy Solutions’ NextStar Energy EV battery plant in Windsor Ontario as well as Volkswagen’s planned EV battery plant in St-Thomas Ontario.

On its own, the Canadian market may pale in comparison to that of the US, but it is also proving itself to be an early innovator (you need to look no further than Waabi, a Canadian business aiming to enable autonomous driving at scale).

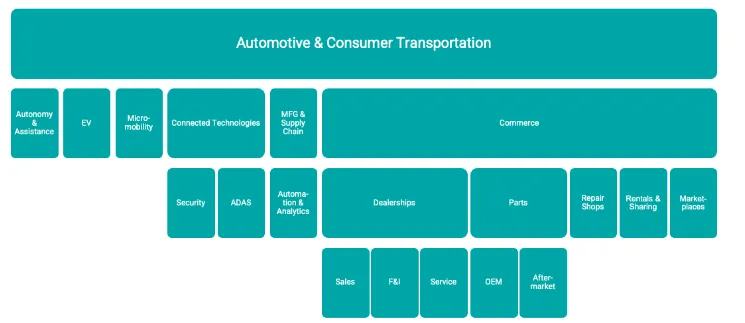

That said, what we’re keen to understand is where software might play a transformative role in this complex industry. Here’s how we think about this market:

In the future, we’ll be delving deeper into many of these sub-segments but our work to-date has shed light on three macro trends that are impacting the sector in its entirety.

1. Autonomy and electrification

Although fully autonomous passenger vehicles are still a work in progress, a 2024 model of nearly any car certainly has a lot more tech packed into it than even five years ago.

This has two downstream effects on the ecosystem: On the one hand, newer vehicles are better at preventing certain types of accidents (low speed collisions being one of them, thanks to ADAS) but on the other, repairs to these vehicles are becoming more complex and thereby costlier both in time and materials.

Electric vehicles accounted for 14% of new vehicle sales globally in 2022 with 35% year-on-year growth forecasted for 2023- a trend that is only accelerating.

EV’s require far less servicing than traditional internal combustion engine (ICE) vehicles and when they do require repairs, the commensurate technician skill set is often new to the already supply-constrained workforce. The growing supply of used (secondhand/off-lease, etc) EVs is also challenging ICE norms around reliability indicators (mileage vs battery health for example) and resulting resale values. Finally, autonomy puts a spotlight on auto insurance. As accident rates decrease, so too should premiums (although EVs are a lot more expensive to repair when they do break), forcing insurers to rethink their products and underwriting methods.

Opportunities that stem from autonomy and electrification include:

Diagnostic and repair tools

Skilled technician training/up-skilling

EV-specific ownership & resale platforms

Cybersecurity products

Data analytics (specifically for insurance)

2. Supply chain disruption and optimization

The COVID-19 pandemic’s impact on supply chains can be felt in every industry, but the automotive sector was, and remains one of the most heavily afflicted. A future supply chain that values supplier diversity and near-shoring is already in the works and the transition to electrification will cement this.

Dealer lots in North America are still full of partially-built vehicles, waiting for parts (usually electronics but also hardware components such as truck axles) and vehicles that are in showrooms are commanding not only full MSRP, but often a dealer-added “surplus” (think of it as an availability tax), often in the order of several thousand dollars. OEMs are looking to optimize supply chain transparency which will allow them to move away from the age old model of pushing inventory to their dealer lots and replacing it with something more akin to just-in-time manufacturing and drop shipping model.

In the meantime, people are owning their cars longer, trading them in less often and opting to extend warranties or setting budget aside for repairs as cars age. More out-of-warranty cars on the road being maintained longer means that new car dollars are shifting into aftermarket parts and aftermarket service, where prices tend to be lower.

We view supply chain disruption and optimization as creating these types of opportunities:

Supply chain insights and automation through data aggregation

Used vehicle marketplaces & financing

Aftermarket parts and service/repair software

3rd party vehicle warranty products

3. Omnichannel distribution

The traditional vehicle purchasing flow is also undergoing a lot of change. From disruption by new entrants such as Tesla who pioneered a showroom-less, direct-to-consumer model, to used car marketplaces that digitize the trade-in process — it is becoming increasingly evident that in order to improve distribution, the age-old model of walking into a dealership and haggling over price must be replaced by pricing transparency.

In a response to this, auto dealers and OEMs are becoming much more collaborative. OEMs, which have historically been arm’s length from the customer, are now looking to close that gap and to access this data through their dealers. OEMs are also looking to optimize supply chain transparency which will allow them to move away from the age old model of pushing inventory to their dealer lots and replacing it with something more akin to a just-in-time or drop shipping model.

Economies of scale are being achieved through dealership consolidation (private or private equity-driven), affording these larger conglomerates an opportunity for deeper vertical integration and consolidating a software ecosystem that has historically been fragmented.

Some examples of how omnichannel distribution is creating new opportunities include:

Dealer Management Systems

Automated analytics and insights (sales, service and F&I)

Last mile logistics solutions

eCommerce platforms

With this much fragmentation in a large, changing market, where will value crystalize for vertical software companies? We look forward to sharing more of our thoughts as we dive deeper into this fascinating industry. In the meantime, if you are building or investing in the Autotech space and we’ve not spoken before, we’d love to hear from you. Don’t hesitate to reach out to Taku Murahwi.