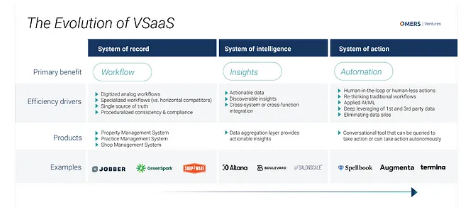

Here on OMERS Ventures’ vertical SaaS team, we make a practice of doing deep dives into specific verticals we think are particularly well suited for breakout vertical SaaS companies. There’s more detailed information on our approach in the appendix, but in short: for us to pursue a particular vertical, we need to see a pathway for a new entrant to achieve $100M+ topline within ~10 years using a well-established, market-tested playbook. We’re also increasingly looking for opportunities that have potential to evolve from pureplay systems of record to systems of intelligence and ultimately systems of action.

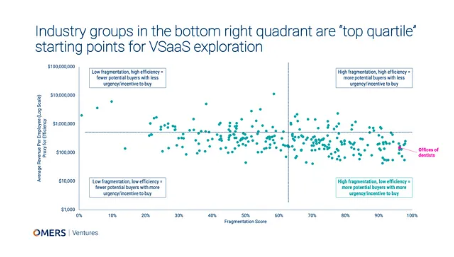

Based on our top-down, macro-level analysis, we hypothesized that the dental vertical might be ripe for these types of opportunities. So following our work in the legal and auto verticals, we set out to uncover the trends in the dental vertical that might support venture-scale vertical SaaS outcomes.

Here’s what we found.

Industry trends

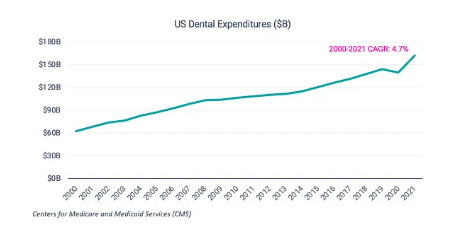

The dental industry has witnessed a growing emphasis on preventive care and patient education, reflecting a broader societal awareness of the importance of oral health. There’s also heightened focus on aesthetics and smile improvement solutions, with a growing awareness of and interest in more cosmetic procedures (e.g., aligners) and advanced specialty procedures (e.g., implants). These trends combined with an aging population requiring more — and more complex — dental work has led to a steady rise in dental expenditure per year.

Access to dental services has always been a concern — with disparities in oral health outcomes related to factors such as income, geography, and insurance coverage — but it’s become even more pressing of a concern in recent years.

The heightened demand has absolutely outpaced the growth in the supply of dental professionals, including dentists, dental hygienists, and dental assistants. This was exacerbated by Covid-19 and there’s no sign that the trend will reverse any time soon. A 2022 research report by the American Dental Association (ADA)’s Health Policy Institute (HPI) concluded:

“The dental sector is facing a serious workforce shortage. Vacant positions in dental assisting and dental hygiene have reduced dental practice capacity by an estimated 10% nationally. One in three dentists who do not have full appointment schedules indicate that trouble filling staffing positions is a contributing factor. Workforce shortages were initially attributed to the COVID-19 pandemic. We now know that is just part of the story. Enrollment in dental assisting programs has been trending downward since 2015, and the pandemic had a negative impact on dental hygiene program enrollment. While there has been some recovery of enrollment in dental hygiene programs, data suggest that dental assisting program enrollment will not rebound in the near future. As a result, workforce shortages are likely to remain an issue for years to come.”

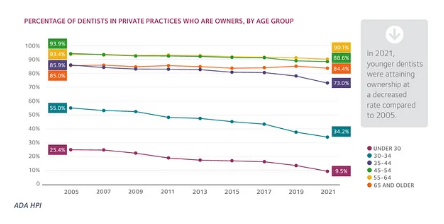

At the same time, there’s a growing generational divide in the dental workforce. The average dentist is getting younger, and this shift will only accelerate in the coming years as the baby boomers leave the profession. These changing demographics and the COVID-19 pandemic have accelerated a shift in practice models.

More specifically, private practice ownership is declining. In 2021, 73% of dentists owned a private practice, down from 85% in 2005. The trend is particularly notable among younger dentists.

The percentage of private practice dentists in solo practice also continues to decline (46.2% in 2021, down from 66.5% in 2001). Again, this trend is most pronounced among younger dentists. Dental school seniors entering private practice increasingly plan to join a dental service organization (DSO) vs. a solo practice (30% of seniors in 2020 vs. 12% in 2015).

Commenting on these trends, Dr. Marko Vujicic, Chief Economist of the ADA’s HPI, recently said: “These trends are not reversible. Dentistry is heading exactly down the path of every other healthcare occupation that’s gone through this transition of business owner/solo practice to working in groups.”

Why are younger dentists behaving so differently than their predecessors? Put simply, they’re of a different generation and a very different mindset: they’re more transient, more focused on work/life balance, and they have higher income expectations. This, combined with increasing dental school debt and rising start-up costs of owning a practice, is pushing new graduates in a different direction.

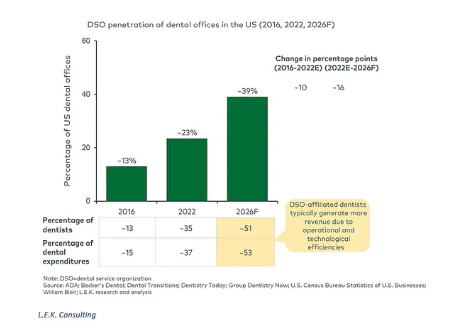

Not only are more dentists joining DSOs, but the DSOs themselves are growing bigger and taking greater share of the dental practice market. By 2026, DSOs are expected to own 39% of all dental offices in the US as well as capturing 51% of all dentists and 53% of all dental expenditures, according to L.E.K. Consulting.

Private equity has played a significant role in fueling their expansion. With over 100 PE-backed platforms today, the dental vertical has been one of the most attractive healthcare investment verticals for PE in recent years.

Compared to other physician practice areas like dermatology, vision, or veterinary, the dental vertical has:

the largest TAM ($166B)

a long track record of consistent revenue growth with relatively inelastic demand

among the highest levels of profitability

the largest provider base (200,000+)

high fragmentation (10% consolidated)

significant value arbitrage that can be generated (5–8x)

Aside from PE buyers’ motivations, there’s also increasing openness on the sellers’ side. The burden of owning and managing a private practice has grown significantly over the last decade because of declining reimbursement rates, rising overhead costs, an increase in regulatory compliance, intensifying workforce challenges, and rising competition from “corporate” dentistry and tech-enabled startups. The desire to reduce this burden is one of the leading reasons why private practice owners are choosing to sell to DSO buyers.

This trend is showing no signs of slowing, and in fact, it’s starting to pick up steam in adjacent areas. “While historically consolidation has focused on GP practices, specialty-focused networks are in earlier stages of consolidation and appear to be following a similar trajectory,” said L.E.K. Consulting Principal Nathalie Herman.

Technology is also having an impact on the industry. Technological innovations, such as digital imaging, 3D printing, and teledentistry continue to play a role in enhancing diagnostics, treatment planning, and patient engagement. That said, “the dental market is very slow to evolve and the maturity of the dental market in the shift to the cloud is in very early innings. The dental practice market is highly fragmented (~130K practices) and only a small portion of practices have moved to the cloud,” said Herman. So, while there remains a lot of opportunity for cloud-based software, the adoption curve is likely slower and shallower than other industries. More to come on that point.

Insurance and payment models are also undergoing changes, with an increased focus on value-based care and alternative payment arrangements. Departing from the traditional fee-for-service model, there is a growing emphasis on outcomes, preventive care, and holistic patient well-being. This change reflects an acknowledgment of the intricate relationship between oral and systemic health. Alternative payment models, including capitation and bundled payments, incentivize dental providers to prioritize cost-effective treatments and collaborative, patient-centered care. As payers seek to control costs and enhance overall healthcare efficiency, dental practices are adapting their services, integrating technology, and emphasizing preventive measures. While these changes offer opportunities for improved patient outcomes, they also pose challenges in measurement and reporting unique to dentistry.

Dental practice software

What goes into running a practice? And where does or could software play a role?

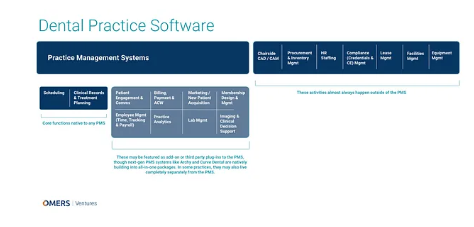

The core activities can generally be categorized into three buckets: front-office, clinical, and back-office.

Front-office tasks are those that involve direct interaction with patients, such as scheduling appointments, managing patient records, handling inquiries, and collecting patient payments.

Back-office functions are typically administrative and operational tasks essential for the smooth functioning of the practice but that don’t involve interaction with patients: insurance billing & claims processing, accounting & bookkeeping, supply chain management, HR, regulatory compliance, facility management, etc.

And clinical tasks are obviously things handled by a licensed dental professional: examining patients, performing diagnostic procedures, planning treatments, etc.

The roles within a dental practice don’t always map clearly to these functional areas. The lines are often blurred, particularly in smaller practices.

The same is true of the software used to manage these tasks. Some software systems are entirely clinical in nature (e.g., imaging software, chairside CAD/CAM, etc.), but most other tasks that have been digitized — spanning front-office, clinical, and some back-office tasks — are managed either directly or indirectly through a Practice Management System (PMS).

The PMS is the central control point for any dental practice and comprises most of the IT budget. The 800-pound gorillas are Henry Schein and Patterson Dental. Yes, the two largest distributors of dental supplies and equipment also have technology businesses. And collectively, they account for ~75–80% of the PMS market. Henry Schein’s Dentrix is #1 with about 50% of the market, Patterson’s Eaglesoft is #2, and then there is a long tail of vendors that have anywhere from 300 to 1,000 practices each (0.2% to 7% share).

There’s an important distinction to make at this point about on-premise vs. cloud-based PMS. Adoption of a PMS isn’t a choice; it’s essential to running a practice. So nearly every practice has some form of PMS. But the vast majority of the market (estimated to be around 85% in 2020) is still using on-premise PMS. Each year, it’s estimated that about 10% of practices are in market for a buying decision, and currently the decision skews 70/30 in favor of on-premise — which is surprisingly high given that the market leaders (Dentrix and Eaglesoft) also have cloud versions available.

Put simply, the dental industry is way behind other industries in terms of cloud adoption, and while most industry experts we talked to expect that to improve over time, they don’t expect it to happen overnight. The main reason being: the transition is painful and time-consuming, and it cuts into time that practices could be spending seeing patients and generating revenue. It takes a ton of work to convince people to switch. We know anecdotally that it’s taken over 10 years for one of the most prominent cloud-based PMS vendors to achieve just 5% market penetration.

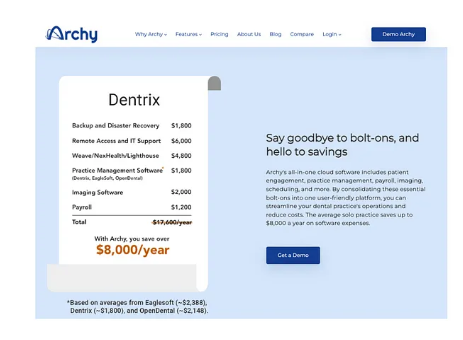

One way newer, cloud-native PMS vendors like Archy have tried to push the ball forward is by offering far superior, lightweight, and intuitive UI/UX and bundling all relevant feature sets into an all-in-one platform. Instead of having to pay separately for add-on modules with Dentrix or Eaglesoft, practices joining their cloud-based systems can pay one flat fee.

This falls against a backdrop where the PMS is gradually expanding its reach beyond its core functionality (patient scheduling and clinical records management), either by way of native feature builds or third-party integrations.

Founder and Chief Strategy Officer at DSO Strategy Dr. Roshan Parikh put it simply: “The PMS is the backbone of the dental practice, but the practice management systems have not evolved to meet the ever-changing demands of the dental provider of today. So, that means many SaaS platforms have started to create ‘bolt on’ applications to solve dental provider and DSO problems.” While the legacy PMS vendors can make it difficult for third-party vendors to integrate (e.g., lacking open APIs), there’s still a growing awareness that they need to expand their reach to fulfill the growing needs of their customer base, so they’re allowing specialized vendors to plug into their ecosystem where there are gaps.

Some examples of third-party PMS integrations include:

Patient engagement/communications: Weave, RevenueWell, SolutionReach, RecallMax

Billing, payments, & RCM: Global Payments, Pearly, Zuub, Airpay

Marketing/new patient acquisition: PatientPop

Membership design & management: Pearly, Illumitrac

Practice analytics: Dental Intelligence, DataDx

Imaging & clinical decision support: Overjet AI, Pearl AI, VideaHealth

All these non-PMS vendors help practice owners perform critical tasks, so they’ve valuable to the end users. But they’re more often than not point solutions, spanning one or two activities/workflows vs. weaving together multiple into a centralized platform with “1+1=3” type benefits. Their integration with the PMS is absolutely essential to their adoption, but with many other point solutions integrated into the PMS as well, it materially hinders their ability to expand outward. We’re not saying it’s impossible to build a venture-scale business with a dental-specific point solution, but it is undoubtedly difficult. It’s why many of these businesses aren’t limited to dental (e.g., Weave serves dental, optometry, veterinary, and medical).

Dental practices don’t spend an exorbitant amount of money on software, they’re notoriously hard and expensive to market to (often requiring boots on the ground field sales, which ACVs aren’t sizeable enough to support), and what they have — even if it’s got a horrible UI/UX, even if it’s a source of major inefficiency or administrative burden, even if it’s potentially losing them patients — is often “good enough.” By and large, dental practice owners don’t run their practices like businesses, so value propositions tied to business-related principles (e.g., incremental revenue generation, opex cost reduction, time savings/productivity gains, etc.) don’t always resonate.

Where this is not the case is with corporate-owned and PE-backed DSOs, which are becoming more pervasive. By default, they are motivated to boost efficiency and profitability. This is perhaps even more pressing of a concern right now, with interest rates and the rise of wages and supply costs for dentists. Jinesh Patel, Co-Founder and CEO of Uptime Health explained, “The squeeze they are feeling at this moment is something many have never had to go through before. They will need to adjust, and it will cause a lot of pain probably through 2024. This may be a catalyst for the industry to adopt new technologies to help with efficiencies and automate administrative/routine level tasks.”

Founder and Chief Strategy Officer at DSO Strategy Dr. Roshan Parikh also sees a need for more advanced data and analytics technology. “More and more DSOs want (and need, I would contend) to truly ‘own’ their own data and have real-time access to the data. For some of these cloud-based PMS, they don’t get their dashboards populated until the next day sometimes,” he said. “Akin to having the Bulls play the LA Lakers today, and not know the score until tomorrow. In today’s day and age, it just makes zero sense.”

But selling to DSOs isn’t necessarily a cakewalk either. Aside from truly enterprise-level applications (e.g., portfolio-level business intelligence), the software needs are largely the same between individual practices and DSOs. And the selling motion reflects it. It usually involves two steps: 1) getting on a preferred vendor list with the corporate entity (you can build an outbound sales team to drive this, but it takes a lot of work and comes with a long sales cycle), and then 2) selling to the individual practices (there’s really no avoiding this!). There can be top-down pressure to standardize systems for something as essential as a PMS (though not always the case), but that’s typically not true for the individual point solutions.

One open question, in our opinion, is: Is there a second control point to be exploited outside the PMS? Is there space for, perhaps, a back office-focused platform to emerge? Maybe one that builds a wedge around a principal activity that currently happens outside of the PMS (e.g., procurement & inventory management) and expands out to handles most of the activities on the right side of that infographic (e.g., HR/staffing, compliance management, lease management, facilities management, equipment management)? If that were to be the case, would it be big enough to support venture-scale returns? If you’re building in this space and/or have thoughts on this general premise, we’d love to hear from you.

We asked a handful of dental industry experts to make a prediction about the future steady state and if the PMS will truly be all-encompassing or if a second control point will emerge. The feedback was decidedly split, with answers on each side resembling the following:

“I think the potential for the PMS to become all-encompassing is high. Given the relative recency of adoption of systems of record, coupled with the speed of technological development meeting the current state of the market favoring large incumbents, it would make sense that many new, innovative companies in the systems of intelligence/action buckets would be rolled up into existing companies who have built large systems of record.”

“I don’t think there will ever be one platform to do everything. Otherwise, solutions will be an inch deep and a mile wide. Different solutions/features affect and benefit every person in the office differently. Each will want to have a software that feel like it’s built for them, whether that’s front office, back office, dentist, hygienist, etc. What they need is more platforms that ‘work together,’ rather than be a single platform. But because front office and back-office solutions are already in their own buckets, I can see a world where there is a tool being the go-to platform for each of those two major buckets.”

The other open question in our mind: when and how will dental software move beyond systems of record and become more akin to systems of intelligence and systems of action?

“Dental in general is still coming around to the fact that electronic systems of record are needed,” said Matt Allen, Co-Founder & CEO of DifferentKind. “I’ve been a dentist for 13 years and I was still charting on paper records in some places when I started out! As such, much of the software has catered to where dentists and dental groups are at, mainly, digitizing most buckets on that infographic.”

However, several new players have entered the dental vertical in recent years, and systems of intelligence and action have become more common, especially as DSOs look to find greater efficiency. Allen added, “Currently, systems of intelligence and action in revenue cycle management are all the rage. I’m excited about some of the innovation I see towards intelligence and action in clinical records and treatment planning, practice analytics and interoperability, and patient engagement/comms.”

Several experts we spoke with envision a future where dental is truly integrated into traditional healthcare/medical.

“The hope is that the ‘mouth’ gets reattached to the rest of the body, in terms of medical-dental integration and a collaborative approach there,” said Parikh.

What that will require, in practice, is a tool that works with both PMS and EHR systems to integrate patient data across platforms (a system of intelligence). “Having someone’s medical records support action/data/decisions that is informed by their medical, dental, optical, etc. professional will be key,” said Patel.

We also asked a panel of dental industry experts: If you could invest all your life savings into one segment of dental practice software, what would it be? Here are some of the responses we got:

“An all-encompassing cloud-based PMS that dental practices would be required to adopt, per US government requirements — because that’s the only way to force these laggards to adopt, by forcing them to.”

“Equipment management, supply chain, or anything back office. Everyone else is building the next new PMS or PMS add-on. This makes that market tougher to penetrate. And if you’re a PMS add-on, the PMS solutions will be your gatekeepers to success, putting your business in their hands. The reason equipment management is so important is it the fact that it’s a critical variable in providing healthcare, yet nearly no one focuses on it from a tech perspective. And for supply chain, the dental world is quite concentrated and in the hands of only a few distribution players that have controlled the field for decades. This means it’s ripe for disruption.”

“I think the greatest opportunities for success in this vertical exist in companies that are building products which will be supported by regulatory tailwinds in the coming 5–10 years. Dental, historically, has been excluded from legislation that has shaped the dental payments space, but that is changing quickly as more and more people recognize that oral health is an essential health benefit.”

If it was easy to identify the best source of venture-backable businesses, everyone would be doing it. Research is never going to tell the full story, and businesses don’t operate in a vacuum. And in this context, our conviction about opportunities in dental software is tempered by the fact that although market opportunities clearly exists, there needs to be a path to overcome slow cloud adoption curves; large, deeply entrenched incumbents; and challenging GTM dynamics. That said, we will continue to keep our finger on the pulse and if you are a founder or you know any founders we should be talking to, please feel free to connect.

Note: A recap of our approach to vertical SaaS investing

This post is part of a series where we share insights into our vertical SaaS research. We have already covered the legal sector and autotech.

This post tells you more about the methodology we used to prioritize our verticals. Our goal is to identify sectors with the highest chance of spawning a breakout vertical SaaS company. We know from studying and investing in vertical SaaS businesses that winners have thrived in fragmented markets, usually replacing pen and paper processes with digital ones. As a result, it made sense to look for fragmented markets with low efficiency (which usually correlates with degree of digitization). This top-down, data-driven analysis pointed to dentistry (specifically, dental offices) as being a particularly attractive vertical to dig into.

But we still needed to do bottom-up analysis to see if all the market dynamics at play would allow a new entrant to follow the vertical SaaS playbook and achieve a venture-scale outcome in our desired timeframe.

What do we mean by “vertical SaaS playbook”?

From our experience studying and investing in vertical SaaS businesses, we know that there is a tried and tested playbook for success. We also know that this playbook may end up being rewritten by AI, and that’s exciting. But for now, to be successful in vertical SaaS you need three things, in this order:

1. To become a control point in the customer’s tech stack. These systems are the center of gravity for data and workflows and are essential pieces of a customer’s tech stack — they’re not “nice-to-have.” Of course, when it comes to vertical software, there are also many point solutions. But the most valuable vertical SaaS companies are built around control points because they offer strategic advantages that can lead to sustainable competitive moats and increased value creation (e.g., through product expansion, customer lock-in, data advantages, economies of scale, network effects, etc.). As an aside, we believe there’s an evolution underway here, with control points gradually evolving from systems of record to system of intelligence and ultimately to systems of action. More on our thoughts on this here.

2. To be able to expand the product offering to adjacent areas. Think Toast: it may have started as a point of sale (PoS) system, but it expanded to facilitate online ordering, inventory management, workforce management, payroll, and more.

3. To extend through the value chain. Not only will the software be valuable for the initial target market, but it will also have the potential to add value to the whole ecosystem, from suppliers to customers, or maybe even acting as a marketplace for the ecosystem.

For us to pursue a particular vertical, we need to see a pathway for a new entrant to achieve $100M+ topline within ~10 years using this playbook. This is the lens through which we will continue our exploration of SaaS businesses targeting the dental vertical. If you believe this approach is flawed, we’d love to hear from you. The more our thesis is challenged, the smarter we all get!