Previously we shared a high-level overview of the opportunities in fintech, highlighting financial wellness as an area we are especially interested in. The possibility of unlocking financial literacy and the ability to create compelling ethical products for those who have traditionally been underserved is vast. And just because a company is ethical and not predatory doesn’t mean it can’t be profitable. We like products that are emerging to prevent people with low incomes from getting trapped in endless debt cycles. The opportunity as we see it includes not just helping people avoid predatory behavior, but empowering people in general to balance their income and expenses and save for the future.

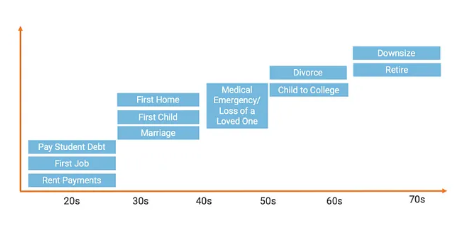

Each stage in life has corresponding financial product requirements that can be challenging and stressful to navigate. Simply knowing what products are available and how to get access to them can be hard enough, but then understanding what a fair charge is and who to trust compounds anxiety at what are usually quite stressful life moments.

For college educated individuals, the first interaction with financial products probably comes after graduation, when student loan repayments are triggered. When entering the workforce there is surprisingly little education around financial literacy — how to read your pay slip, how tax is calculated and deducted, how 401(K) contributions work. The list goes on.

Is there a need?

Today, financial wellness in North America is catastrophic. 37% of Americans don’t have enough money to cover a $400 emergency expense, up from 32% in 2021 (Fed’s 2022 Economic Well-Being of U.S. Households). 20% of Americans said the largest non-emergency expense they could cover using savings was $100. And only 31% of non-retirees said their retirement savings plan was on track at the end of last year (down 9% from 2021).

It seems that necessities and financial security are not being met.

Unfortunately, all signs point to poor financial health for large swathes of our population persisting as a result of the perma-crisis we are living in: the pandemic, political unrest, an overloaded healthcare system, climate change disruption, and economic uncertainty all contributing to income inequality, which is rising globally.

In addition, real earnings are not keeping up with inflation. A tight labor market has caused real average weekly earnings to increase only 1.3% compared to 7% inflation increase over the last year.

If ever there was a time for technology to unlock financial literacy, and products for those who have traditionally been underserved, it is now.

One might assume that individuals should take responsibility for their own financial wellness. But, the individual typically doesn’t have the financial knowledge, time, or resources to improve their financial wellness. Historically, a financial advisor would take responsibility for their client’s financial wellness. However, financial advisors are feeling pressured to improve margins by doing more with less and not accepting clients with less than $500,000 in liquid assets. At times, even when consumers can access advisors, they can be perceived as uninterested in acquiring new customers or show low engagement due to being spread too thin.

While the intent of government to create social security plans for the ageing population were initially altruistic and capable of providing a healthy retirement benefit, today they cannot be relied upon.

The US government recognizes the predicament of its citizens and is attempting to resolve it. Conversations being had in the Senate right now to cap credit card interest rates are harbingers of change. Secure Act 2.0 is Congress’s attempt to address the lack of retirement preparedness. Several implications of the Act include:

Better catch-up contributions for those workers that are behind, up to 150% per year until they reach their limit;

Extending the mandatory age where withdrawals from a retirement plan need to occur;

Converting education savings up to $35,000 to IRAs if not used for college; and

Emergency withdrawal up to $1,000 without penalty (typically 10%) with the option to recontribute the amount within 3 years.

Also, there are upcoming provisions mandated by the US government that impact employers. New US employer-sponsored plans starting in 2025 will have to automatically enroll participants in a 401(k) with a default contribution rate of at least 3% of an employee’s salary, increasing 1% annually up to 10%. Employers can set up and automatically enroll an employee in an emergency savings account with an automatic employee contribution of 3% or less, up to $2,500.

We’ve seen this play out before — the UK implemented a new law in 2012, phased in over 5 years, requiring employers to auto-enroll their employees. Since the new UK law, 10 million UK employees have been auto-enrolled into pension plans and overall workplace pension coverage increased from less than 50% to 79% ten years later. And the legislation has created space for innovation to thrive.

It’s movements like this that will prompt real innovation in financial services, focusing on giving customers products that add real value.

So for the average person, on a steady income, help for current or future planning is unlikely to come via independent financial advisors or government. As such, we are increasingly seeing employers step into this role. Why? Well, their motives are not purely altruistic, and therein lies the opportunity. Increasingly employer support for financial wellness will be expected by employees and will act as a talent attraction and retention tool.

Today, distractions around financial wellness are already costing employers money through absenteeism and loss of productivity. Financial health is gaining parity with physical and mental health in the workplace. According to the 2023 Wellness Barometer Survey Summary Findings (April 2023):

92% of employees are stressed about finances

64% of employees say financial stress has worsened their relationships. It impacts their mental (72%) and physical health (60%)

74% of employees were not happy with employer financial benefits

Estimate is that the impact to US businesses is US$200B annually

All our research suggests employers are actively searching for solutions. There are three areas we’re looking at including:

Planning: turnkey, holistic solutions that analyze and recommend a plan based on an individual’s income and expense load.

Infrastructure: APIs and integrations that augment other businesses in their efforts to offer financial wellness services.

Tech enabled services: money management services such as financial planning, but with high-scale capacity.

In speaking with people responsible for global HR and total rewards in substantial businesses, we’ve heard that financial wellness is being elevated in importance. Employee wellness is about supporting the full individual so that they can be their best, productive self at work. In many cases that means social, mental and financial health.

Where’s the venture opportunity?

Many vendors have appeared that are thinking about financial wellness and services as illustrated in the market landscape below.

But who will win in the market?

Financial planning has traditionally been a high-touch, low scale industry. Today’s challengers are ‘data-first’ working towards bespoke solutions while addressing venture-scale head on. We are seeing live support fees built-in or offered on an a-la-carte basis — typically Certified Financial Planners. Potentially there may be alternative referral/AUM fee opportunities, although many employers find this to be a conflict of interest.

A venture scale business is building a data-first solution from the ground up, with deep awareness of the customer, driving value while creating lots of high-touch opportunities. Our belief is that the company that has a complete employee data profile by leveraging consumer banking data from Plaid, Flinks, and MX and matching it with employment data from Argyle, Atomic, and Pinwheel, and then creates avenues to use it will win in the market. On top of this, a robust content and data strategy enables automation of education, driving greater financial literacy.

Our research has produced consistent feedback on employers’ desired functionality and design. We believe businesses that are emerging to address the needs outlined above, and ticking the boxes below, have the potential for enormous scale:

Orchestration of existing employee’s benefit plans and compensation programs (including 401k/RRSP and equity plans) to provide visibility and actionable insights.

Deep integration with all areas of employee’s financial and employer data to provide a holistic overview of financial wellness.

Self-service, software-first augmented by live human support options. This support often comes from Certified Financial Planners who are prepared with a complete 360 view of the employee and can do more than just answer questions.

Optimization for life events (eg. marriage, childbirth, illness of loved one, divorce, retirement) in an effort to be there when the employee needs it most.

It stands to reason that the companies that will win in this space will have:

A network of reliable Certified Financial Planners;

Go-to-market through a B2B2C model relying on channel partners such as health benefits providers, benefits brokers and HR tech focused platforms for distribution scale; and

A pricing model that is based on a SaaS platform fee plus an engaged employee fee.

If this sounds like you — we want to connect! Even if you aren’t in the process of fundraising, we want to do our part to help this ecosystem thrive. Please don’t hesitate to reach out to Laura, or Dave.