Written by Laura Lenz, Partner, OMERS Ventures

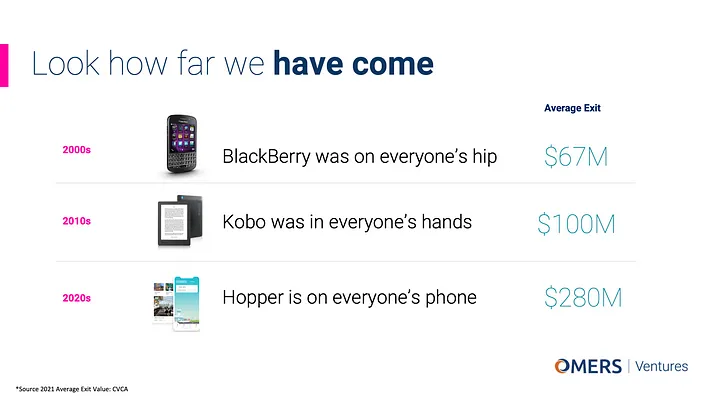

Over a year ago, we started to notice that something exciting was happening in Canada — the tech ecosystem was maturing in multiple cities across the country, financing round sizes were getting bigger, and exit values were dramatically improving. If you remember the days when a Blackberry was on everybody’s hip, the average exit value was $67 million. Fast forward to the days when a Kobo was in everybody’s hands, the average exit value was $100 million. And now, when Hopper is on everybody’s smartphone, the average exit value is approximately $280 million.

I was supposed to be onstage at TechExit this week, but the virus had other plans for me (a big shout out to Charlie Renzoni who took to the stage in my absence!), so I’m sharing my thoughts here about what 2021 has taught us. In case we either didn’t know or frankly, just chose to ignore some previous learnings.

Q1 2022 didn’t materialize how we thought it would last year. Inflationary concerns coupled with geo-political uncertainty has left a lot of jittery investors. More than 70% of tech IPOs are trading below their IPO issue price. This has resulted in not one IPO in Q1 from venture-backed, Canadian tech companies. Most investment bankers that you speak with will tell you the IPO window is firmly shut for at least the first half of 2022. Bankers are closely watching the US IPO markets, often a market leader for Canada, for signals of a reopening. And when it does, we can guarantee that companies going public will be of the highest quality — solid and market-resilient revenue growth and strong software gross margins.

The M&A market fared slightly better, from a pure number of deals standpoint, with 19 M&A deals (source: PitchBook Data) announced. However, the largest announced transaction size was $116 million and so there were no new names added to the Canadian Tech Exit Top 25 list this quarter.

The largest announced acquisition on the list during the quarter was CloudMD’s $116 million acquisition of MindBeacon. Going back to when everybody had a blackberry on their hip (and a time that, incidentally, the CEO and co-founder of MindBeacon was my boss), this would be a great Canadian outcome. But, times have changed, and, I am definitely hoping that this isn’t a reflection of the future, but of one company’s journey as a public company that ultimately led to an acquisition. According to the company’s press release, MindBeacon was purchased for $116 million, representing an implied transaction enterprise value of approximately $62 million and an EV/2022E revenue of 1.9x.

Which brings me to some of the important learnings from 2021. Admittedly, these four statements have always been true, but during frothy times are easily forgotten or pushed aside for want of the next shiny object.

Market timing is important: According to a recent Keybanc study, the average EV/forward revenue multiple for publicly-traded SaaS companies hit an all-time high of 17x in February 2021. The average EV/forward revenue multiple since January 2005 was 5.9x. That of course includes the high of 17x but also the low in 2008 of 2x. Let me illustrate this in an example. In 2005, a company forecasting to grow to $10M the following year was worth $59M while in early 2021 a similar company forecasting to grow to $10M the following year was worth $170M. Those that were lucky enough to raise in February 2021 likely raised much larger rounds of capital to execute on their growth plans for far less dilution.

Metrics still matter: Revenue growth mattered the most in 2021 as many investors forgot to look further down the income statement to gross margin, or sigh, net income. A reminder this quarter that the potential for future profitability, coupled with revenue growth is important again. Investors want to know when a company will be profitable and how much capital it will require to achieve the scale required to be profitable.

Valuation always needs to be supported: Companies that raised in these high multiple times have the benefit of a war chest. But, they also have the pressure of needing to grow into their valuation, or, what I call “the earn-in” value. Let’s take that same company illustrated above, that was lucky enough to raise at a 17x forward multiple and was forecasted to hit $10M in revenue. Well, that $10M of revenue required flawless execution, including hiring BDRs and AEs that were hard to recruit in the talent shortage. So instead of $10M in revenue, the company hit $7M of revenue. The company has definitely made some progress, but not enough to clear through a market correction. Because now multiples have compressed to 8–10x. And one could argue those multiples are on current revenue as forecasted revenue is a little harder to predict these days. So now the company is sitting at $56M of implied value and needs to “earn-in” another $114M of value just to get to the assigned valuation at the last financing round. This equates to generating an additional $14M of revenue before they can raise again at a flat valuation round. My colleague Damien writes about it in more detail here.

Decisions made in the present will impact the future: The decision to raise at a high valuation in frothy markets impacts the success of future private capital raises, as illustrated above. It also can impact a public listing too. Of the tech companies that completed an IPO in 2016, 42% were priced at a downround to the most recent private financing valuation. That means that almost half of the IPO issuance had a mis-aligned and likely, unhappy, board at the time of the IPO.

So, what can we expect for the remainder of 2022? Well, I might not be able to answer that, but, I will leave you with some perspective on what to think about in that next investor meeting or board meeting.

Be realistic about valuation expectations

Ensure your metrics have some best-in-class rankings and that you can clearly illustrate both areas of growth and improvement

Find unbiased advice in trusted advisors and independent board members

Ensure your investors are financially aligned

Find an investing partner with a shared vision for the company and a shared set of values with the founder

Give your company optionality for the future — start fundraising relationships and strategic conversations early

There’s still a lot to be positive about despite current market conditions. There is plenty of capital still to be deployed by VCs that have raised new funds recently. We are seeing incredible Canadian companies, tackling big global problems, on a regular basis. And if history has taught us anything, it is that some of the best companies emerge from the most challenging times. We remain very excited about what the future holds.