Themes

Fintech

Founded

OMERS First Investment

Both sides of the table

The relationship between founder and investor is a critical one. In good times and bad. We share a little bit of background about how these relationships are built.

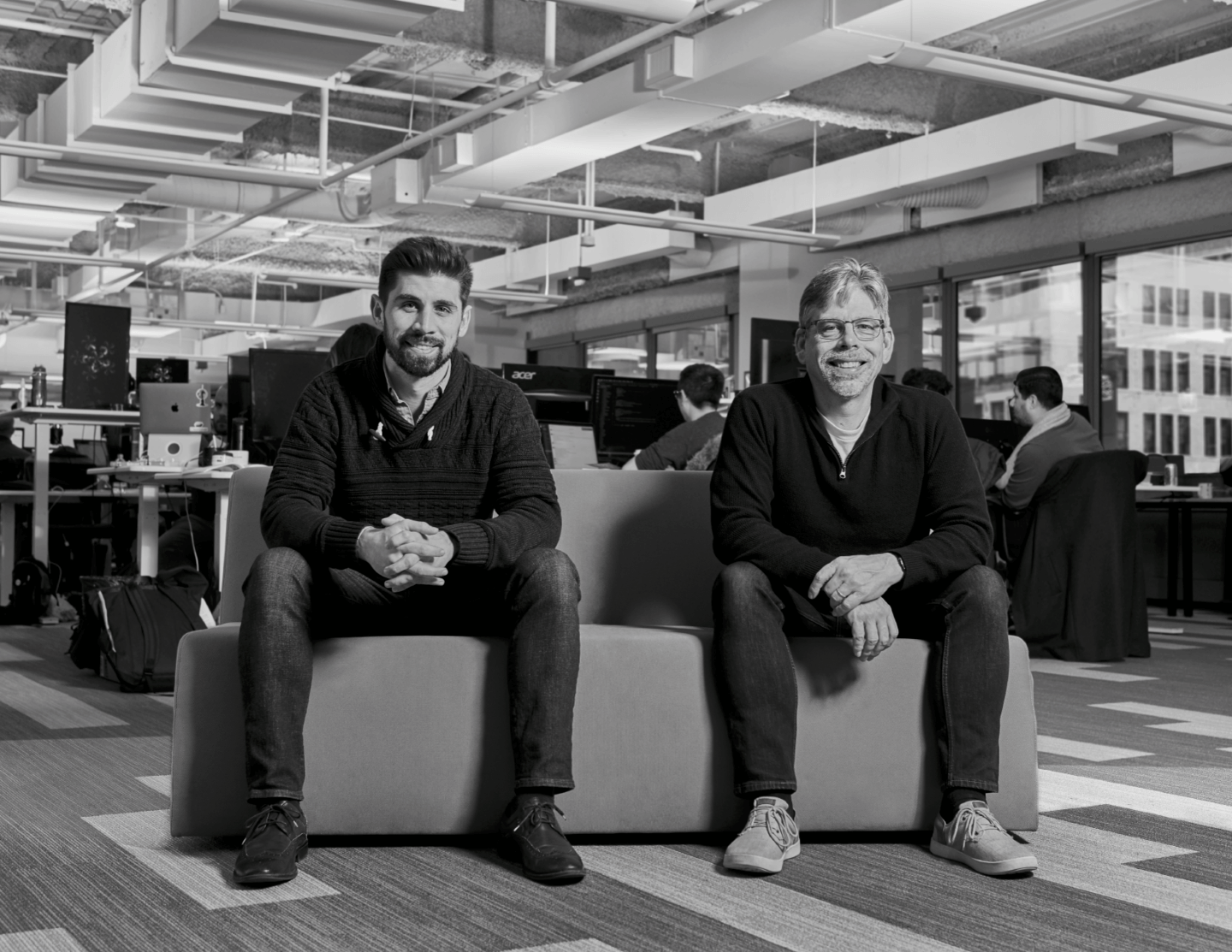

Kyle

Michael and I originally met years ago when both were investors. We were with different firms, looking at the same company to invest in. So, we had at least a surface idea of how we each operated, but we had never worked closely together. Years later, and not long after I left a traditional insurance business to start a company of my own, a mutual contact reconnected us. I thought we’d been reconnected because Michael was a potential investor in our series C. Apparently, he remembers it differently!

Michael

When I think back to my first real interactions with Kyle, what immediately comes to mind is how generous he was with his time and knowledge about the insuretech space. We were just starting to formulate our investment strategy in the US and I thought insuretech was a contender for one of the four verticals to target. Kyle wasn’t raising at the time, and he invested a lot of time helping me and the team go deep into the evolution of insurance in the digital age. Once we decided insuretech was viable, we really started to dive into the personal lines – auto and homeowners. The more we learned about Clearcover, the more we liked the approach Kyle and his team were taking. It was counterintuitive, dissimilar to what every other insuretech founder was pitching us.

Kyle

Once Michael and the team decided insuretech was a target vertical, we began to talk more seriously about OV investing in Clearcover. They kicked off a more formal due diligence process, but it was so clear that they were being thoughtful at every stage to make sure they didn’t waste our time. They took the process in steps. And what stood out most is that the team took the time to understand the insurance business. It’s almost impossible to pattern match an insuretech to a SaaS business, and Michael knew that. He really understood why that was the case. It’s that deep understanding of our business and the market dynamic that

got them over the finish line with us.

I was also hugely impressed that at the Partner meeting where we presented our business, Michael had also included colleagues from the UK who had recently invested in a fast-growing European insuretech, Wefox. So that team got our business too.

Michael

I could tell early on that we had the potential to be a good fit with Clearcover. The OMERS

relationship means we can genuinely play a long game, and the most successful and robust insurance businesses are built over 20-30 year timeframes, not five to ten. That sort of business lends itself to having investors on the cap table who don’t have a ‘growth at all costs’ mentality. Because in insurance, it’s easy to go grow quickly – but if you get it wrong, it’s equally easy to fail spectacularly. An insurance book needs to stand the test of time.

Kyle

We weren’t actively raising when OV lead our Series C. I don’t think we even did a traditional deck. We wrote a memo about the business, the market and the opportunity, and attached our financials separately. But by that time Michael and his team knew our business inside out. As a founder it’s always better to raise from someone where you’ve got an existing relationship that’s built on more than just the urgent need to get money in the bank.

When it comes to building a hugely successful insurance business, the formula may be simple, but the road is long. The decisions we make about our business today are the decisions that we need to live with over the next 20 years. It means we need to be pragmatic and we need investors who are willing to be pragmatic too.

Michael

Yeah, we get that. Which is why it’s critical to have a senior team that’s willing to constantly run tests and experiments, and then optimize. Supporting a management team by giving them a wide berth to nurture a culture of experimentation is important. The other important thing to say about Kyle and the entire Clearcover management team is that they sweat the small stuff – the operational intricacies of running an insurance operation. With all the hyperbole and suspension of disbelief that some other insuretech players appear to propagate it’s nice to be in a board room just focused on brass tacks. Again, insurance

is a long game and we’re just getting going at Clearcover.

Kyle

We lean on Michael for advice a lot. He has seen a vast number of companies going through exactly the stage we’re at now, so if he can help us create shortcuts and avoid certain pitfalls, we’re all for it. He doesn’t lack empathy or understanding, but he’s not afraid to be direct. Experienced investors tend to know that no matter how much homework you do on a Company, there will always be things that are broken. In a high growth business that’s just part of the game. Michael and the team aren’t phased by it.

The OV team has been really good on the networking front – especially helping us secure independent board members. Michael has also connected us with other founders in the portfolio and been generous in connecting us with relevant people and experts within other OMERS assets when we needed them.

Michael

Clearcover has continued its impressive growth since the day we invested in 2019. The biggest surprise since we cut that first check is how seamlessly the company has been able to move to remote-first in response to the pandemic and maintain its culture as the team grew. It’s a testament to what Kyle and the team have built. And the stats continue to blow me away: this’ll be the third straight year of [triple] digit growth. The company has 400 people in 20 states. When we first invested, it had closer to 50 people than 100 and was only really doing business in 2 states.

Kyle

We have big ambitions for Clearcover and we look to our future with a healthy combination of excitement and trepidation. Our target for this year is $100M in revenue…it may sound big,

but that’s one day’s revenue at one of the traditional insurance giants. It’s all there to play for, so I never want us to get complacent.

When I am in the physical office, which happens a lot less these days, I still use the first desk we ever bought. It helps me keep everything in perspective.

Michael

In a market that’s flush with capital where deals are being done in record time, I am reminded of the importance of long-term relationship-building. From our very first meeting, whether he knew it or not, Kyle was paying it forward. They say you make your own luck, and this could hardly be a better example to reinforce the truth in that saying. It might sound like the stars aligned to make our investment in Clearcover ‘just happen’ but it was the result of lots of investment and time on both our parts. Inevitably that will pay dividends for everyone. The last thing I’ll say is that our experience here has given us even more conviction to double down our investment efforts in insuretech. To all future OV insuretech investments, let’s raise glass to Kyle an Clearcover.